UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]☒

Filed by a Party other than the Registrant [ ]☐

Check the appropriate box:

| | [ ]☐ | Preliminary Proxy Statement |

| | | |

| | [ ]☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| | | |

| [X]☒ | Definitive Proxy Statement |

| | | |

| | [ ]☐ | Definitive Additional Materials |

| | | |

| | [ ]☐ | Soliciting Material Pursuant to Rule Sec.240.14a-12§240.14a-12 |

U.S. GOLD CORP.

(Name of Registrant as Specified Inin Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X]Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ | No fee required |

| | |

[ ]☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.paid previously with preliminary materials |

| | |

(1)☐ | Title of each class of securities to which transaction applies: |

| |

(2) | Aggregate number of securities to which transaction applies: |

| |

(3) | Per unit price or other underlying value of transactionFee computed pursuant toon table in exhibit required by Item 25(b) per Exchange Act RuleRules 14a-6(i)(1) and 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) | Proposed maximum aggregate value of transaction: |

| |

(5) | Total fee paid: |

| |

[ ] | Fee paid previously with preliminary materials: |

| |

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) | Amount previously paid: |

| |

(2) | Form, Schedule or Registration Statement No.: |

| |

(3) | Filing Party: |

| |

(4) | Date Filed: |

U.S. GOLD CORP.

777 Alexander Road

Princeton, NJ 08543

(609) 799-0071

Dear Shareholder,

You are cordially invited to attend the 2017 Annual Meeting of Shareholders (the “Annual Meeting”) of U.S. Gold Corp. to be held at 10:00 a.m. (local time) on July 31, 2017, at the office of Sichenzia Ross Ference Kesner LLP, 61 Broadway, 32ndFloor, New York, NY 10006. The attached notice of Annual Meeting and proxy statement describe the matters to be presented at the Annual Meeting and provide information about us that you should consider when you vote your shares.

The principal business of the meeting will be (i) to elect as directors the nominees named in this proxy statement to serve until 2018 Annual Meeting of Shareholders and until their successors are duly elected and qualified, (ii) to ratify the appointment of Marcum LLP as our independent public accountant for the fiscal year ending April 30, 2018, (iii) to advise us as to whether you approve the compensation of our named executive officers (Say-on-Pay), (iv) to approve the Company’s 2017 Equity Incentive Plan and the reservation of 1,650,000 shares of common stock for issuance thereunder and (v) to transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof.

We hope you will be able to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, it is important that your shares are represented. Therefore, when you have finished reading the proxy statement, you are urged to complete, sign, date and return the enclosed proxy card promptly in accordance with the instructions set forth on the card. This will ensure your proper representation at the Annual Meeting, whether or not you can attend.

| Sincerely, |

| |

| Edward M. Karr |

| President and Chief Executive Officer, Director

|

YOUR VOTE IS IMPORTANT.

PLEASE RETURN YOUR PROXY PROMPTLY.October 26, 2022

U.S. GOLD CORP.

777 Alexander Road1910 East Idaho Street, Suite 102-Box 604,

Princeton, NJ 08543Elko, Nevada 89801

(609) 799-0071(800) 557-4550

NOTICE OF ANNUAL MEETING OF SHAREHOLDERSSTOCKHOLDERS

To be Held July 31, 2017TO BE HELD December 16, 2022

To the ShareholdersStockholders of U.S. Gold Corp.:

NOTICE IS HEREBY GIVEN that the 20172022 Annual Meeting of ShareholdersStockholders (the “Annual Meeting”) of U.S. Gold Corp., a Nevada corporation (the “Company”), will be held at 10:9:00 a.m. (local time)Mountain Time on July 31, 2017,December 16, 2022, or such later date and time as such Annual Meeting date may be adjourned, in a virtual format only via live website at www.usgold.vote. The Annual Meeting will be held for the following purposes:

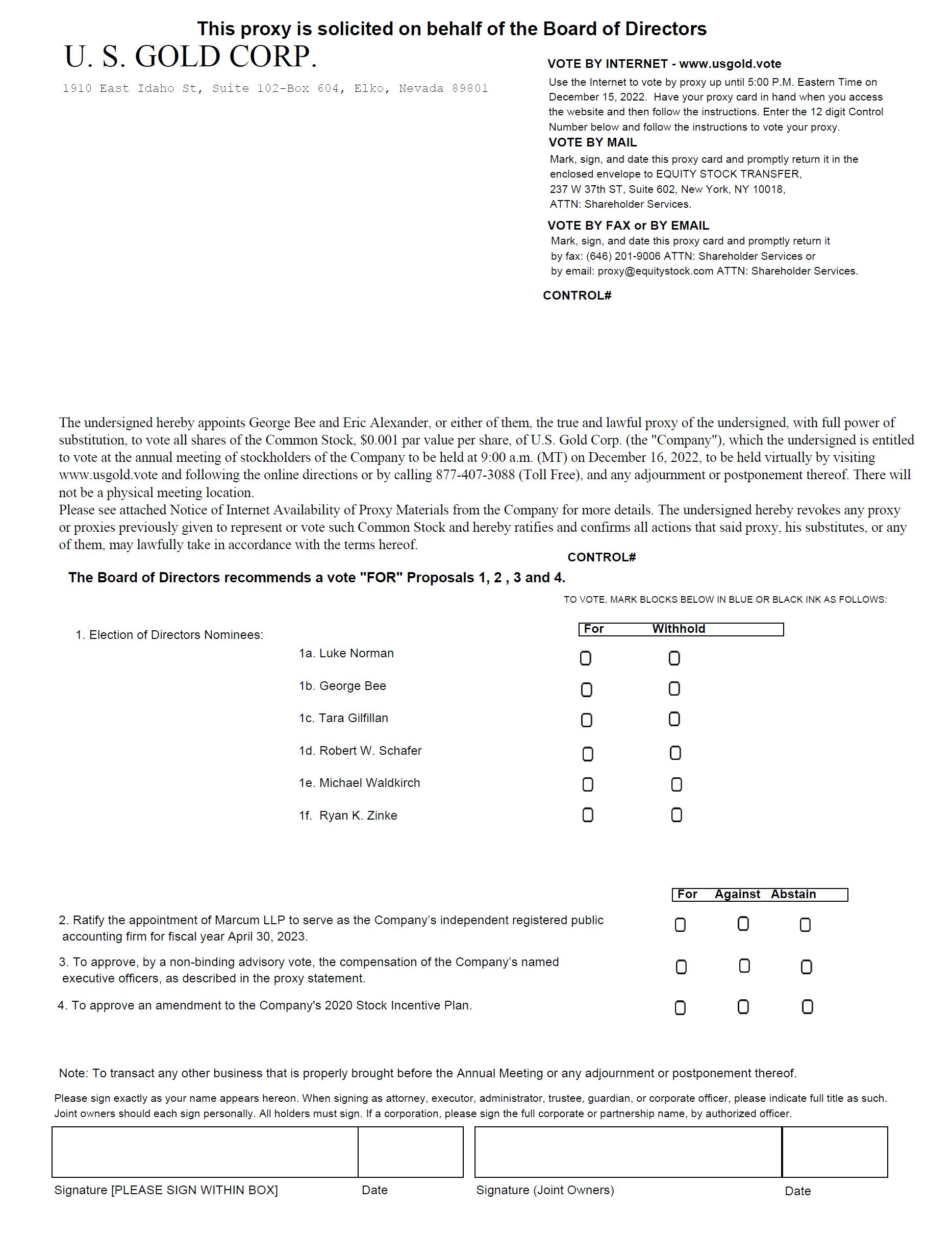

| 1. | To elect the six (6) nominees named in this proxy statement to serve on the Board of Directors (the “Board of Directors” or the “Board”) until the 2023 Annual Meeting of Stockholders or until their successors are duly elected and qualified (the “Election of Directors Proposal”). |

| | |

| 2. | To ratify the appointment of Marcum LLP as our independent registered public accountant for the fiscal year ending April 30, 2023 (the “Auditor Ratification Proposal”). |

| | |

| 3. | To approve, by a non-binding advisory vote, the compensation of our named executive officers, as described in this proxy statement (the “Say-on-Pay Proposal”). |

| | |

| 4. | To approve an amendment to the Company’s 2020 Stock Incentive Plan (the “Plan Proposal”). |

In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof. Stockholders are referred to the proxy statement for more detailed information with respect to the matters to be considered at the Annual Meeting. The Board of Directors recommends a vote “FOR” Proposals 1, 2, 3 and 4.

In light of public health concerns regarding the coronavirus outbreak, this year’s Annual Meeting will be conducted in a virtual format only in order to assist in protecting the health and well-being of our stockholders and employees and to provide access to our stockholders regardless of geographic location. Stockholders will not be able to attend the Annual Meeting in person; however, stockholders of record will be able to participate, vote electronically and submit questions during the live website of the Annual Meeting by visiting www.usgold.vote and entering the control number found on the voting form. If you encounter any difficulties accessing the virtual Annual Meeting, please call the technical support number available on the virtual meeting page on the morning of the Annual Meeting.

Our Board has set October 25, 2022, as the record date for the Annual Meeting and any adjournment(s) or postponement(s) thereof. Only stockholders of record as of the close of business on October 25, 2022, are entitled to notice of, and to vote at, the Annual Meeting. This Notice of Annual Meeting of Stockholders and related proxy materials are first being distributed or made available to stockholders beginning on or about October 26, 2022.

Your vote is important. Please read the proxy statement and the instructions on the proxy card and then, whether or not you plan to attend the Annual Meeting, and no matter how many shares you own, please submit your proxy promptly by telephone or via the Internet, or by completing, dating and returning your proxy card in the envelope provided. This will not prevent you from voting at the Annual Meeting. It will, however, help to assure a quorum and to avoid added proxy solicitation costs.

You may revoke your proxy at any time before the vote is taken by delivering to the office of the Corporate Secretary of U.S. Gold Corp. a written revocation or a proxy with a later date (including a proxy by telephone or via the Internet) or by voting your shares virtually at the Annual Meeting, in which case your prior proxy would be disregarded.

| BY ORDER OF THE BOARD OF DIRECTORS |

| |

| /s/ Eric Alexander |

| Eric Alexander |

| Chief Financial Officer and Corporate Secretary |

| October 26, 2022 |

TABLE OF CONTENTS

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF STOCKHOLDERS

U.S. GOLD CORP.

1910 East Idaho Street, Suite 102-Box 604,

Elko, Nevada 89801

(800) 557-4550

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

The Board of Directors (the “Board of Directors” or the “Board”) of U.S. Gold Corp. is soliciting the enclosed proxy for use at the 2022 Annual Meeting of Stockholders (referred to herein as the “Annual Meeting”) to be conducted in a virtual format only via live website at www.usgold.vote on Friday, December 16, 2022, at 9:00 a.m. Mountain Time, or such later date or dates as such Annual Meeting date may be adjourned, at the office of Sichenzia Ross Ference Kesner LLP, 61 Broadway, 32nd Floor, New York, NY 10006, for the purpose of considering and taking action on the following proposals:adjourned.

| 1. | Elect as directors the nominees named in the proxy statement; |

| 2. | To ratify the appointment ofMarcum LLPas our independent public accountant for the fiscal year ending April 30, 2018; |

| 3. | To advise us as to whether you approve the compensation of our named executive officers (Say-on-Pay); |

| 4. | To approve the Company’s 2017 Equity Incentive Plan, including the reservation of 1,650,000 shares of common stock thereunder; and |

| 5. | To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

The foregoing business items are more fully describedIn light of public health concerns regarding the coronavirus (“COVID-19”) outbreak, this year’s Annual Meeting will be conducted in a virtual format only in order to assist in protecting the following pages, which are made parthealth and well-being of this notice.our stockholders and employees and to provide access to our stockholders regardless of geographic location. Stockholders will not be able to attend the Annual Meeting in person; however, stockholders of record will be able to participate, vote electronically and submit questions during the Annual Meeting.

The Board recommends that you voteThis proxy statement is furnished to holders of our common stock as follows:

| ● | “FOR” for the election of the Board nominees as directors; |

| ● | “FOR” ratification of the selection ofMarcum LLPas our independent public accountant for our fiscal year ending April 30, 2018; |

| ● | “FOR” the compensation of our named executive officers as set forth in this proxy statement; and |

| ● | “FOR” approval of the Company’s 2017 Equity Incentive Plan, including the reservation of 1,650,000 shares of common stock thereunder |

You may vote if you were the record ownerdate as part of the Company’s common stock at the closesolicitation of business on July 10, 2017. Theproxies by our Board of Directors ofin connection with the Companyproposals to be presented at the Annual Meeting. Our Board has fixed the close of business on July 10, 2017set October 25, 2022, as the record date (the “Record Date”) for. Only holders of our common stock as of the determinationclose of shareholdersbusiness on October 25, 2022 are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments thereof.

Meeting. As of the Record Date, there were 11,029,2708,348,136 shares of our common stock issued and outstanding. Each share of common stock outstanding entitled to vote at the Annual Meeting. The foregoing shares are referred to herein as the “Shares,” holders of the Shares are entitled tohas one vote for each Share held. A list of shareholders of record will be available at the meeting and, during the 10 days prior to the meeting, at the office of the Secretary of the Company at 777 Alexander Road, Princeton, NJ 08543.

All shareholders are cordially invited to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, you are requested to complete, sign, date and return the enclosed proxy card as soon as possible in accordance with the instructions on the proxy card. A pre-addressed, postage prepaid return envelope is enclosed for your convenience.

By Order of the Board of Directors of U.S. Gold Corporation,

| Sincerely, |

| |

| Edward M. Karr

|

| President and Chief Executive Officer, Director

|

YOUR VOTE AT THE SPECIAL MEETING IS IMPORTANT

Your vote is important. Please vote as promptly as possible even if you plan to attend the Meeting.

For information on how to vote your shares, please see the instruction from your broker or other fiduciary, as applicable, as well as “Information About the Meeting and Voting” in the proxy statement accompanying this notice.

We encourage you to vote by completing, signing, and dating the proxy card, and returning it in the enclosed envelope.

If you have questions about voting your shares, please contact our Corporate Secretary at U.S. Gold Corp, at 777 Alexander Road, Suite 100, Princeton, NJ 08540, telephone number (609) 799-0071.

If you decide to change your vote, you may revoke your proxy in the manner described in the attached proxy statement/prospectus at any time before it is voted.

We urge you to review the accompanying materials carefully and to vote as promptly as possible. Note that we have enclosed with this notice a proxy statement/prospectus.

THE PROXY STATEMENT IS AVAILABLE AT:http://equitystock.com/issuers/

By Order of the Board of Directors,

| Sincerely, |

| |

| Edward M. Karr

|

| President and Chief Executive Officer, Director

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting OF SHAREHOLDERS to Be Held onJuly 31,2017 at10:00A.M. EDT.

The Notice of Annual Meeting of Shareholders and our Proxy Statement are available at:

http://equitystock.com/issuers/

|

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement incorporates important business and financial information about U.S. Gold Corp. that is not included in or delivered with this document. You may obtain this information without charge through the Securities and Exchange Commission (“SEC”) website (www.sec.gov) or upon your written or oral request by contacting the Chief Executive Officer of U.S. Gold Corp., 777 Alexander Road, Suite 100, Princeton, New Jersey 08540 or by calling (609) 799-0071.

To ensure timely delivery of these documents, any request should be made no later than July 20, 2017 to receive them before the annual meeting.

For additional details about where you can find information about U.S. Gold Corp., please see the section entitled “Where You Can Find More Information” in this proxy statement.

Table of Contents

U.S. GOLD CORP.

777 Alexander Road

Princeton, NJ 08543

(609) 799-0071

FOR U.S. GOLD CORP.

2017 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 31, 2017

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

This proxy statement, along with the accompanying notice of the 2017 Annual Meeting of Shareholders, contains information about the 2017 Annual Meeting of Shareholders of U.S. Gold Corp., including any adjournments or postponements thereof (referred to herein as the “Annual Meeting”). We are holding the Annual Meeting at 10:00 a.m. (local time) on July 31, 2017, at the office of Sichenzia Ross Ference Kesner LLP, 61 Broadway, 32nd Floor, New York, NY 10006, or such later date or dates as such Annual Meeting date may be adjourned. For directions to the meeting, please call (609) 799-0071.

vote. In this proxy statement, we refer to U.S. Gold Corp. as “USG,” the “Company,” “we,” “us” or “our.”

Why Did You Send Me This Proxy Statement?The executive offices of the Company are located at, and the mailing address of the Company is 1910 East Idaho Street, Suite 102-Box 604, Elko, Nevada 89801.

We sent you this proxy statement in connection with the solicitationIMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON DECEMBER 16, 2022, AT 9:00 A.M. MOUNTAIN TIME

As permitted by the Board of Directors“Notice and Access” rules of the Company (referred to herein asU.S. Securities and Exchange Commission (the “SEC”), the “Board of Directors” or the “Board”) of proxies, in the accompanying form, to be used at the Annual Meeting to be held at 10:00 a.m. (local time) on July 31, 2017, at the office of Sichenzia Ross Ference Kesner LLP, 61 Broadway, 32nd Floor, New York, NY 10006 and any adjournments thereof. This proxy statement along with the accompanying Notice of Annual Stockholder Meeting, of Shareholders summarizes the purposesour proxy statement, a form of the Annual Meetingproxy card and the information you need to know to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on July 31, 2017: The proxy statement andour annual report to security holders are available at www.usgold.gold.

This proxy statement, the accompanying proxy and, though not part of this proxy statement, our 2016 Annual Report, which includes our financial statementson Form 10-K for the fiscal year ended April 30, 2016,2022 (the “Annual Report”) are being mailedavailable online at: www.usgold.vote.

This proxy statement and the accompanying form of proxy are dated October 26, 2022. On or about October 28, 2022, we commenced mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) that contains instructions on how stockholders may access and review all of the proxy materials and how to vote. Also, on or about July 14, 2017October 28, 2022, we began mailing printed copies of the proxy materials to all shareholdersstockholders that previously requested printed copies. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

Information About the Annual Meeting and Voting

Why am I receiving these proxy materials?

The Board of Directors of the Company is asking for your proxy for use at the 2022 Annual Meeting to be conducted in a virtual format only via live webcast at www.usgold.vote on December 16, 2022 at 9:00 a.m. Mountain Time, and at any adjournment or postponement of the Annual Meeting. As a stockholder, you are invited to attend the virtual Annual Meeting and are entitled to noticeand requested to vote on the items of business described in this proxy statement.

This proxy statement is furnished to stockholders of U.S. Gold Corp., a Nevada corporation, in connection with the solicitation of proxies by the Board of Directors on behalf of the Company for use at the Annual Meeting.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials?

We are using the SEC’s Notice and Access model (“Notice and Access”), which allows us to deliver proxy materials over the Internet, as the primary means of furnishing proxy materials. We believe Notice and Access provides stockholders with a convenient method to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about October 28, 2022, we began mailing to stockholders a Notice of Internet Availability containing instructions on how to access our proxy materials on the Internet and how to vote online. The Notice of Internet Availability is not a proxy card and cannot be used to vote your shares. If you received a Notice of Internet Availability this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the Notice of Internet Availability.

What should I do if I receive more than one set of voting materials?

You may receive more than one Notice of Internet Availability (or, if you requested a printed copy of the proxy materials, this proxy statement and the proxy card) or voting instruction card. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a Notice of Internet Availability (or, if you requested a printed copy of the proxy materials, a proxy card) for shares held in your name and a voting instruction card for shares held in “street name.” Please follow the separate voting instructions that you received for your shares of common stock held in each of your different accounts to ensure that all of your shares are voted.

Who is soliciting my vote?

The Board of Directors is soliciting your vote on behalf of the Company. Our officers, directors, and employees may also solicit proxies personally or in writing, by telephone, e-mail, or otherwise. These officers and employees will not receive additional compensation but will be reimbursed for out-of-pocket expenses. Brokerage houses and other custodians, nominees, and fiduciaries, in connection with shares registered in their names, will be asked to forward solicitation material to the beneficial owners of such shares. We will reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation materials and collecting voting instructions.

When were the solicitation materials first given to stockholders?

This proxy statement and the accompanying form of proxy are dated October 26, 2022. We expect to commence mailing to our stockholders a Notice of Internet Availability indicating that this proxy statement, a proxy card, and our 2022 Annual Report are available on or about October 28, 2022.

How Does The Board Recommend That I Vote On The Proposals?

The Board recommends that you vote as follows:

| ● | “FOR” the Election of Directors Proposal; |

| ● | “FOR” the Auditor Ratification Proposal; |

| ● | “FOR” the Say-on-Pay Proposal; and |

| ● | “FOR” the Plan Amendment and Restatement Proposal. |

If any other matter is presented, the proxy card provides that your shares will be voted by the proxy holder listed on the proxy card in accordance with his or her best judgment. At the time this proxy statement was published, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

Who is entitled to vote at the meeting. You can also find a copy of our 2016 Annual Report on Form 10-K onmeeting, what is the Internet through the Securities“record date”, and Exchange Commission’s electronic data system called EDGAR atwww.sec.gov or through the “Investors” section of our website atwww.usgoldcorp.gold.how many votes do they have?

Who Can Vote?

Shareholders who owned USGHolders of record of our common stock at the close of business on July 10, 2017 (the “Record Date”), areOctober 25, 2022 will be entitled to vote at the Annual Meeting. Onmeeting. As of the Record Date, there were 11,029,2708,348,136 shares of USGour common stock issued and outstanding. Each share of common stock is entitled to one vote.

What is a quorum of stockholders?

In order to carry on the business of the Annual Meeting, a quorum must be present. If 33 1/3% of the shares outstanding and entitled to vote. Thevote on the record date are present, either in person (by attending via live website www.usgold.vote) or by proxy, we will have a quorum at the meeting. Any shares represented by proxies that are marked for, against, withhold, or abstain from voting on a proposal will be counted as present in determining whether we have a quorum. If a broker, bank, custodian, nominee, or other record holder of our common stock indicates on a proxy card that it does not have discretionary authority to vote certain shares on a particular matter, and if it has not received instructions from the beneficial owners of such shares as to how to vote on such matters, the shares held by that record holder will not be voted on such matter (referred to as “broker non-votes”) but will be counted as present for purposes of determining whether we have a quorum. There were 8,348,136 shares of our common stock issued and outstanding on the Record Date, and each share of common stock are herein referred to as the “Shares.”has one vote. The presence of holders of 2,782,712 (33 1/3%) votes will represent a quorum.

How many votes does it take to pass each matter?

Proposal 1: Election of Directors Proposal | | The nominees for director who receive the most votes (also known as a plurality) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| | |

Proposal 2: Auditor Ratification Proposal | | The affirmative vote of a majority of the votes cast for or against this proposal is required to ratify the appointment of the Company’s independent public accountant. Abstentions will not be counted as either a vote cast for or against this proposal. Broker non-votes are not applicable to the Auditor Ratification Proposal because your broker has discretionary authority to vote your shares with respect to such proposal. We are not required to obtain the approval of our stockholders to appoint the Company’s independent accountant. However, if our stockholders do not ratify the appointment of Marcum LLP as the Company’s independent public accountant for the fiscal year ending April 30, 2023, the Audit Committee of the Board may reconsider its appointment. |

| Proposal 3: Say-on-Pay Proposal | | The affirmative vote of a majority of the votes cast for this proposal is required to approve, on a non-binding basis, the compensation of our executive officers. Abstentions and broker non-votes will not be counted as either votes cast for or against this proposal. While the results of this advisory vote are non-binding, the Compensation Committee of the Board and the Board as a whole value the opinions of our stockholders and will consider the outcome of the vote, along with other relevant factors, in deciding whether any actions are necessary to address the concerns raised by the vote and when making future compensation decisions for executive officers. |

| | |

| Proposal 4: Plan Proposal | | The affirmative vote of a majority of the votes cast for this proposal is required to approve an amendment to the 2020 Stock Incentive Plan. Abstentions will be counted towards the tabulation of votes cast on this proposal and will have the same effect as a negative vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for this proposal. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

Who may attend and how do I attend?

All holders of our common stock as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting (via webinar or phone call). Set forth below is a summary of the information you need to attend the Annual Meeting:

| ● | Access the webinar by visiting www.usgold.vote and following the webinar registration link and have your control number available to enter for verification; |

| | |

| ● | Access the audio-only conference call by calling 877-407-3088 (Toll Free) or +1-877-407-3088 (International); |

| | |

| ● | Instructions on how to attend and participate in the Annual Meeting, including how to demonstrate proof of stock ownership, are also available as follows: |

| ■ | Stockholders of record as of the Record Date can attend the Annual Meeting by visiting www.usgold.vote and following the webinar registration link to register at any time prior to the start of the Annual Meeting or by calling the live audio conference call at +1-877-407-3088 and presenting your unique control number on the proxy card. |

| ■ | If you were a beneficial owner of record as of the Record Date (i.e., you held your shares in an account at a brokerage firm, bank or other similar agent), you will need to obtain a legal proxy from your broker, bank or other agent. Once you have received a legal proxy from your broker, bank or other agent, it should be emailed to our transfer agent, Equity Stock Transfer, at proxy@equitystock.com and should be labeled “Legal Proxy” in the subject line. Please include proof from your broker, bank or other agent of your legal proxy (e.g., a forwarded email from your broker, bank or other agent with your legal proxy attached, or an image of your valid proxy attached to your email). Requests for registration must be received by Equity Stock Transfer no later than 5:00 p.m. Eastern Time, on December 14, 2022. You will then receive a confirmation of your registration, with a control number, by email from Equity Stock Transfer. At any time prior to the start of the Annual Meeting, visit www.usgold.vote and follow the instructions for webinar registration or access the live audio conference call at +1-877-407-3088 and present your unique control number. |

| | |

| ■ | Stockholders may submit live questions via webinar or on the conference line while attending the Annual Meeting. |

What if I have technical difficulties or trouble accessing the Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have in accessing the Annual Meeting. If you encounter any difficulties, please call: 877-804-2062 (Toll Free) or email proxy@equitystock.com.

How to participate in and vote at the meeting

If you are a shareholder of record, you can participate and vote your shares in the Annual Meeting by visiting www.usgold.vote and then clicking “Vote Your Proxy”. You may then enter the control number included on your Proxy Card and view the proposals and cast your vote.

If you are a beneficial owner of shares held in street name, you can participate and vote at the meeting by obtaining a legal proxy from your nominee and emailing a copy to proxy@equitystock.com no later than 5:00 p.m. Eastern Time, on December 14, 2022. You will be able to vote your shares. Shares representedshares at the meeting by valid proxies, received in time forgoing to www.usgold.vote and clicking “Vote Your Proxy”. You will then enter the same control number you used to enter the meeting.

Even if you plan to attend the Annual Meeting, and not revoked prior to the Annual Meeting,we recommend that you also vote by proxy as described below so that your vote will be voted at the Annual Meeting. A shareholder may revoke a proxy before the proxy is voted by deliveringcounted if you later decide not to our Secretary a signed statement of revocation or a duly executed proxy card bearing a later date. Any shareholder who has executed a proxy card but attends the Annual Meetingparticipate in person may revoke the proxy and vote at the Annual Meeting.

How Many Votes Do I Have?to vote without participating in the meeting

Each shareShareholders of USG common stock thatrecord may vote without participating in the Annual Meeting by any of the following means:

By Internet. The website address for Internet voting is www.usgold.vote. Please click “Vote Your Proxy” and enter your control number.

By Email. Mark, date, sign and email the Proxy Card to proxy@equitystock.com, ATTN: Shareholder Services.

By mail. Mark, date, sign and mail promptly the Proxy Card, ATTN: Shareholder Services.

By Fax. Mark, date, sign and fax the Proxy Card to 646-201-9006, ATTN: Shareholder Services.

At the Annual Meeting: If you own entitlesare a shareholder of record, you to onecan participate and vote your shares in the Annual Meeting by visiting www.usgold.vote and then clicking “Vote Your Proxy”. You may then enter the control number included on your Proxy Card and view the proposals and cast your vote.

If you vote by Internet, fax or email, please do not mail your Proxy Card.

Because of possible delays with the mails, we recommend you use the Internet or telephone to vote.

If you are a beneficial owner of shares held in street name, you must email to proxy@equitystock.com a legal proxy from your nominee authorizing you to vote your shares no later than 5:00 p.m. Eastern Time on December 14, 2022. Once submitted, you will receive a control number enabling you to vote your shares by any of the means set forth above.

What is a proxy?

A proxy is another person you authorize to vote on your behalf. We ask stockholders to instruct the proxy how to vote so that all common shares may be voted at the meeting even if the holders do not attend the meeting.

How are abstentions and broker non-votes treated?

Abstentions and broker non-votes count for purposes of determining the presence of a quorum. Broker non-votes will not be counted as votes cast either for or against Proposal 1, 3 and 4 and will have no impact on the result of the vote on these proposals. Broker non-votes are not applicable to Proposal 2 because your broker has discretion to vote your shares on such proposals. Abstentions will not be counted as votes cast either for or against Proposals 1, 2 and 3; however, abstentions on Proposal 4 will have the same effect as a negative vote on that proposal.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for or against“withheld” for each nominee for director, and whether your shares should be voted for, against or abstain with respect to each of the other proposals. Except as set forth below, if you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’sBoard of Director’s recommendations as noted below. The Board has appointed George Bee and Eric Alexander, or either of them, to serve as the proxy for the Annual Meeting. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, Equity Stock Transfer, or you have stock certificates, you may vote:

| | ●1. | By mail. CompleteInternet. The website address for Internet voting is www.usgold.vote. Please click “Vote Your Proxy” and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance withenter your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by the Board.control number. |

| | 2. | By Email. Mark, date, sign and email the Proxy Card to proxy@equitystock.com, ATTN: Shareholder Services. |

| | ●3. | In person atBy mail. Mark, date, sign and mail promptly the meeting.Proxy Card, ATTN: Shareholder Services. |

| 4. | By Fax. Mark, date, sign and fax the Proxy Card to 646-201-9006, ATTN: Shareholder Services. |

| 5. | At the Annual Meeting. If you attend the meeting,are a shareholder of record, you may delivercan participate and vote your completed proxy cardshares in person or you may vote by completing a ballot, which will be available at the Annual Meeting.Meeting by visiting www.usgold.vote and then clicking “Vote Your Proxy”. You may then enter the control number included on your Proxy Card and view the proposals and cast your vote. |

If you hold your shares in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. See “If my shares are held in “street name” (held in the name of a bank,by my broker, or other nominee),will my broker vote my shares for me?” Alternatively, if you must provide the bank, broker or other nominee with instructions on howwant to vote your shares during the Annual Meeting, you must contact your nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder is not the same as a nominee-issued proxy. If you fail to present a nominee-issued proxy to proxy@equitystock.com by 5:00 p.m. Eastern Time on December 14, 2022, you will not be able to vote your nominee-held shares during the Annual Meeting.

YOUR PROXY CARD WILL BE VALID ONLY IF YOU COMPLETE, SIGN, DATE, AND RETURN IT BEFORE THE MEETING DATE.

How will my proxy vote my shares?

If your proxy card is properly completed and canreceived, and if it is not revoked, before the meeting, your shares will be voted at the meeting according to the instructions indicated on your proxy card. If you are a record holder and sign and return your proxy card, but do sonot give any voting instructions, your shares will be voted as follows:

| | ● | By Internet or by telephone. Follow the instructions you receive from your broker to vote by Internet or telephone. |

| | |

| ● | By mail. You will receive instructions from your broker or other nominee explaining how to vote your shares. |

| | |

| ● | In person at the meeting. Contact the broker or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the meeting. You will not be able to attend the Annual Meeting unless you have a proxy card from your broker. |

How Does The Board Recommend That I Vote On The Proposals?

The Board recommends that you vote as follows:

| ● | “FOR” for the election of the Board nominees as directors; |

| ● | “FOR” ratification of the selection ofMarcum LLPas our independent public accountant for our fiscal year ending April 30, 2018; |

| ● | “FOR” the compensationElection of our named executive officers as set forth in this proxy statement;Directors Proposal; |

| ● | “FOR” the Auditor Ratification Proposal; |

| ● | “FOR” the Say-on-Pay Proposal; and |

| | ● | “FOR” approval of the Company’s 2017 Equity Incentive Plan including the reservation of 1,650,000 shares of common stock thereunderAmendment and Restatement Proposal. |

IfTo our knowledge, no other matters will be presented at the meeting. However, if any other matter ismatters of business are properly presented, the proxy card provides that your shares will be voted by the proxy holder listedholders named on the proxy card in accordance with his or her bestare authorized to vote the shares represented by proxies according to their judgment. At the time this proxy statement was printed, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

| ● | signing a new proxy card and submitting it as instructed above; |

| ● | if yourmy shares are held in street name, re-voting by Internet or by telephone as instructed above — only your latest Internet or telephone vote will be counted; |

| | |

| ● | if your shares are registered in your name, notifying USG’s Secretary in writing before the Annual Meeting that you have revoked your proxy; or |

| | |

| ● | attending the Annual Meeting in person and voting in person. Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy unless you specifically request it. |

What If I Receive More Than One Proxy Card?

You may receive more than one proxy card or voting instruction form if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please“street name” by my broker, will my broker vote in the manner described under “How Do I Vote?” on the proxy cardmy shares for each account to ensure that all of your shares are voted.

Will My Shares Be Voted If I Do Not Return My Proxy Card?me?

If your shares are registered in your name or if you have stock certificates, they will not be voted if you do not return your proxy card by mail or vote at the Annual Meeting as described above under “How Do I Vote?”. If your shares are held in street name and your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter, or because your broker chooses not to vote on a matter for which it does have discretionary voting authority, this is referred to as a “broker non-vote.” The New York Stock Exchange (“NYSE”) has rules that govern brokers who have record ownership of listed company stock (including stock such as ours that is listed on The Nasdaq Capital Market) held in brokerage accounts for their clients who beneficially own the shares. Under these rules, brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“routine matters”), but do not have the discretion to vote uninstructed shares as to certain other matters (“non-routine matters”). Under NYSE interpretations, Proposal 1 (election of directors), Proposal 3 (advisory vote to approve executive compensation), and Proposal 4 (approval of the 2017 Equity Incentive Plan) are considered non-routine matters, and Proposal 2 (the ratification of our independent public accountant)

The following matter is considered a routine matter. If your shares are held in street name andTherefore, if you do not provide voting instructionsvote on this proposal, your brokerage firm may choose to the bank, brokervote for you or other nominee that holdsleave your shares as described above under “How Do I Vote?,” the bank, broker or other nominee has the authority, even if it does not receive instructions from you, to vote your unvoted shares for Proposal 2 (the ratification of our independent public accountant), but does not have authority to vote your unvoted shares for Proposal 1 (election of directors), Proposal 3 (advisory vote to approve executive compensation), and Proposal 4 (approval of the 2017 Equity Incentive Plan). We encourage you to provide voting instructions. This ensures your shares will be voted at the Annual Meeting in the manner you desire.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Proposal 1: Election of Directors | | The nominees for director who receive the most votes (also known as a plurality) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| | |

Proposal 2: Ratification of the Appointment ofMarcum LLPas Our Independent Public Accountant for the Fiscal Year Ending April 30, 2018 | | The affirmative vote of a majority of the votes cast for this proposal is required to ratify the appointment of the Company’s independent public accountant. Abstentions will be counted towards the tabulation of votes cast on this proposal and will have the same effect as a negative vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our shareholders to appoint the Company’s independent accountant. However, if our shareholders do not ratify the appointment of Marcum LLP as the Company’s independent public accountant for the fiscal year ending April 30, 2018, the Audit Committee of the Board may reconsider its appointment. |

Proposal 3: Advisory Vote to Approve the Compensation of Our Named Executive Officers | | The advisory vote to approve the compensation of our executive officers will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. Abstentions and broker non-votes will not be counted as either votes cast for or against this proposal. While the results of this advisory vote are non-binding, the Compensation Committee of the Board and the Board values the opinions of our shareholders and will consider the outcome of the vote, along with other relevant factors, in deciding whether any actions are necessary to address the concerns raised by the vote and when making future compensation decisions for executive officers. |

| | |

Proposal 4: Approval of the Company’s 2017 Equity Incentive Plan | | The affirmative vote of a majority of the votes cast for this proposal is required to approve the 2017 Equity Incentive Plan. Abstentions will be counted towards the tabulation of votes cast on this proposal and will have the same effect as a negative vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for this proposal. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the Shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of shareholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Householding of Annual Disclosure Documents

The Securities and Exchange Commission (the “SEC”) previously adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or brokers holding our shares on your behalf to send a single set of our annual report and proxy statement to any household at which two or more of our shareholders reside, if either we or the brokers believe that the shareholders are members of the same family. This practice, referred to as “householding,” benefits both shareholders and us. It reduces the volume of duplicate information received by you and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once shareholders receive notice from their brokers or from us that communications to their addresses will be “householded,” the practice will continue until shareholders are otherwise notified or until they revoke their consent to the practice. Each shareholder will continue to receive a separate proxy card or voting instruction card.

Those shareholders who either (i) do not wish to participate in “householding” and would like to receive their own sets of our annual disclosure documents in future years or (ii) who share an address with another one of our shareholders and who would like to receive only a single set of our annual disclosure documents should follow the instructions described below:this proposal:

| | ● | shareholders whose shares are registered in their own name should contact our transfer agent, Equity Stock Transfer, and inform them of their request by calling them at 212-575-5757 or writing them at 237 W. 37th Street, Suite 601, New York, New York 10018.Proposal 2: Auditor Ratification Proposal |

Applicable rules, however, do not permit brokerage firms to vote their clients’ unvoted shares on the following proposals:

| | ● | Proposal 1: Election of Directors Proposal; |

| | ● | Shareholders whose shares are held by a broker or other nominee should contact such broker or other nominee directlyProposal 3: Say-on-Pay Proposal; and inform them of their request, shareholders should be sure to include their name, the name of their brokerage firm |

| ● | Proposal 4: Plan Amendment and their account number.Restatement Proposal. |

Therefore, if you do not vote on these proposals, your shares will remain unvoted on those proposals. We urge you to provide voting instructions to your brokerage firm so that your vote will be cast on those proposals.

How do I revoke my proxy and change my vote prior to the meeting?

If you are a registered stockholder (meaning your shares are registered directly in your name with our transfer agent) you may change your vote at any time before voting takes place at the meeting. You may change your vote by:

| 1. | Delivering voter instructions to U.S. Gold Corp., ATTN: Corporate Secretary, 1910 East Idaho Street, Suite 102-Box 604, Elko, Nevada 89801, with a written notice dated later than the proxy you want to revoke stating that the proxy is revoked, which notice must be received before 5:00 p.m. ET on December 14, 2022; |

| 2. | Completing and sending in voter instructions with a later date; or |

| 3. | Attending the Annual Meeting and voting virtually. |

For shares you hold beneficially or in “street name,” you may change your vote by submitting new voting instructions to your bank, broker or other nominee or fiduciary in accordance with that entity’s procedures, or if you obtained a legal proxy form giving you the right to vote your shares, by virtually attending the Annual Meeting and voting during the Annual Meeting.

Who is paying forDo I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No. None of our stockholders has any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

What are the solicitation expenses and who pays the cost of this proxy solicitation?

Our Board is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of common stock and collecting voting instructions. We may use officers and employees of the Company to ask for proxies, as described below.

Is this proxy statement the only way that proxies are being solicited?

No. In addition to mailed proxy materials, our directors,the solicitation of proxies by use of the Notice of Internet Access, officers and employees of the Company may also solicit the return of proxies, in person,either by mail, telephone, telecopy, e-mail or by other means of communication. We will not pay our directors,through personal contact. These officers and employees anywill not receive additional compensation for soliciting proxies. We may reimburse brokerage firms, bankstheir efforts but will be reimbursed for out-of-pocket expenses. Brokerage houses and other agents forcustodians, nominees and fiduciaries, in connection with shares of the costcommon stock registered in their names, will be requested to forward solicitation material to the beneficial owners of forwarding proxy materials to beneficial owners.shares of common stock.

When are shareholder proposals due for next year’s annual meeting?Are there any other matters to be acted upon at the Annual Meeting?

At our annual meeting each year, our Board of Directors submitsManagement does not intend to shareholders its nomineespresent any business at the Annual Meeting for election as directors. In addition,a vote other than the Board of Directors may submitmatters set forth in the Notice and has no information that others will do so. If other matters requiring a vote of the stockholders properly come before the Annual Meeting, it is the intention of the persons named in the form of proxy to vote the shareholders for action atshares represented by the annual meeting.proxies held by them in accordance with applicable law and their judgment on such matters.

Where can I find voting results?

We expect to publish the voting results in a current report on Form 8-K, which we expect to file with the SEC within four business days after the Annual Meeting.

Who can help answer my questions?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the information contained in this proxy statement. We urge you to carefully read this entire proxy statement, including the documents we refer to in this proxy statement. If you have any questions, or need additional materials, please feel free to contact our Corporate Secretary, Eric Alexander, at 800-557-4550.

Proposals to be Presented at the Annual Meeting

We will present four proposals at the meeting. We have described in this proxy statement all of the proposals that we expect will be made at the meeting. If any other proposal is properly presented at the meeting, we will, to the extent permitted by applicable law, use your proxy to vote your shares of common stock on such proposal in our best judgment.

PROPOSALS OF SECURITY HOLDERS AT 2023 ANNUAL MEETING

Pursuant to Rule 14a-8 under the Securities Exchange Act, of 1934, shareholders may present proper proposalsa stockholder proposal submitted for inclusion in the Company’sour proxy statement for considerationthe 2023 annual meeting must be received no later than June 30, 2023. However, pursuant to such rule, if the 2023 annual meeting is held on a date that is before November 16, 2023 or after January 15, 2024, then a stockholder proposal submitted for inclusion in our proxy statement for the 2023 annual meeting must be received by us a reasonable time before we begin to print and mail our proxy statement for the 2023 annual meeting. Such proposal must be submitted on or before the close of business at the 2018our headquarters at 1910 East Idaho Street, Suite 102-Box 604, Elko, Nevada 89801, Attention: Secretary.

Stockholders wishing to submit proposals to be presented directly at our next annual meeting of shareholdersstockholders instead of by submitting their proposals to the Company in a timely manner.These proposals must meet the shareholders eligibility and other requirements of the SEC. To be considered for inclusion in next year’s proxy materials, youstatement must submit yourfollow the submission criteria set forth in our bylaws, and applicable law concerning stockholder proposals. To be timely in connection with our next annual meeting, a stockholder proposal concerning director nominations or other business must be received by the Company at its principal executive offices between August 18, 2023 and September 17, 2023; provided, however, if and only if the 2023 annual meeting is not scheduled to be held between November 16, 2023 and February 24, 2024, such stockholder’s notice must be received by the Company at its principal executive offices not earlier than 120 days prior to the date of the 2023 annual meeting and not later than the later of (A) the tenth day following the date of the public announcement of the date of the 2023 annual meeting or (B) the date which is 90 days prior to the date of the 2023 annual meeting.

OTHER MATTERS

Should any other matter or business be brought before the meeting, a vote may be cast pursuant to the accompanying proxy in writingaccordance with the judgment of the proxy holder. The Company does not know of any such other matter or business.

ANNUAL REPORT ON FORM 10-K

Our Annual Report is available online at www.usgold.vote. Upon the written request of a stockholder, the Company will provide, without charge, a copy of its Annual Report, including the financial statements and schedules and documents incorporated by April 2, 2018reference therein but without exhibits thereto, as filed with the SEC. The Company will furnish any exhibit to our Corporate Secretary,the Annual Report to any stockholder upon request and upon payment of a fee equal to the Company’s reasonable expenses in furnishing such exhibit. All requests for the Annual Report or its exhibits should be addressed to Chief Financial Officer, U.S. Gold Corp., 777 Alexander Road, Princeton, NJ 08543.1910 E. Idaho Street, Suite 102-Box 604, Elko, NV 89801 or ir@usgoldcorp.gold.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of July 10, 2017,the Record Date, with respect to the beneficial ownership of the outstanding Common Stock bycommon stock by: (i) any holder of more than five (5%) percent; (ii) each of the Company’s executive officers, directors and directors;director nominees; and (iii) the Company’s directorsexecutive officers and executive officersdirectors as a group. The percentages of voting securities beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition of the security. Except as otherwise indicated, each of the shareholdersstockholders listed below has sole voting and investment power over the shares beneficially owned and addresses are c/o U.S. Gold Corp., 777 Alexander Road,1910 East Idaho Street, Suite 100, Princeton, NJ 08540.102-Box 604, Elko, Nevada 89801. For each current director and nominee for director, each executive officer named in the table and our directors and executive officers as a group, percentage of common stock ownership is based on 8,348,136 shares of common stock issued and outstanding as of the Record Date. For each owner of more than 5% of our common stock, the percentage of ownership is as of the Record Date unless otherwise indicated.

| | | | Amount and Nature of Beneficial Ownership(1,2,3) | |

| Name of Beneficial Owner | | Role | | Number | | | Percent | |

| Edward M. Karr | | Chief Executive Officer, President and Director of USG and Director of Dataram Memory | | | 290,244 | | | | 2.6 | % |

| | | | | | | | | | | |

| David A. Moylan | | President and Director of Dataram Memory and Director of USG | | | 53,527 | | | | * | |

| | | | | | | | | | | |

| Anthony M. Lougee | | Chief Financial Officer of USG and Dataram Memory | | | 9,831 | | | | * | |

| | | | | | | | | | | |

| Timothy M. Janke | | Director of USG | | | 20,833 | | | | * | |

| | | | | | | | | | | |

| James Dale Davidson | | Director of USG | | | - | | | | * | |

| | | | | | | | | | | |

| John N. Braca | | Director of USG | | | - | | | | * | |

| | | | | | | | | | | |

| Directors and Executive Officers as a group (6 persons) | | | | | 374,435 | | | | 3.4 | % |

| | | | | | | | | | | |

| 5% or Greater Shareholders | | | | | - | | | | | |

| | | Amount of Beneficial Ownership

of Common Stock(1,2) | |

| Name of Beneficial Owner | | Number | | | Percent | |

| Luke Norman(3) | | | 463,828 | | | | 5.56 | % |

| | | | | | | | | |

| George Bee(4) | | | 168,829 | | | | 2.02 | % |

| | | | | | | | | |

| Tara Gilfillan(5) | | | 13,237 | | | | * | |

| | | | | | | | | |

| Robert W. Schafer(6) | | | 114,757 | | | | 1.37 | % |

| | | | | | | | | |

| Michael Waldkirch(7) | | | 19,450 | | | | * | |

| | | | | | | | | |

| Ryan K. Zinke(8) | | | 30,861 | | | | * | |

| | | | | | | | | |

| Eric Alexander(9) | | | 3,903 | | | | * | |

| | | | | | | | | |

| Kevin Francis(10) | | | 1,437 | | | | * | |

| | | | | | | | | |

| Current Directors and Executive Officers as a group (8 persons) | | | 816,302 | | | | 9.78 | % |

| | | | | | | | | |

| Phoenix Gold Fund Ltd(11) | | | 628,652 | | | | 7.53 | % |

* Less than 1%.

(1)The number of shares has been adjusted to reflect the reverse 1-for-4 stock split effective May 8, 2017.

(2)On July 10, 2017 11,029,270 shares of Common Stock and Common Stock equivalents were outstanding.

(3)Beneficial ownership includes all stock options and restricted units held by a shareholder that are currently exercisable or exercisable within 60 days of July 10, 2017 (which would be September 8, 2017).

| (1) | The number of shares has been adjusted to reflect the reverse 1-for-10 reverse stock split effective March 17, 2020. |

| (2) | Beneficial ownership includes all stock options, warrants and restricted awards held by a shareholder that are currently exercisable or exercisable within 60 days of October 25, 2022. |

| (3) | Includes: (i) 307,098 unrestricted shares of common stock, (ii) 3,463 shares of common stock underlying vested restricted stock units, (iii) options to purchase 5,310 shares of common stock, all of which are currently exercisable and (iv) warrants to purchase 147,957 shares of common stock, all of which are currently exercisable. Mr. Norman has no voting rights with respect to the restricted stock units until the underlying shares are issued. |

| | 12(4) | Includes: (i) 164,077 unrestricted shares of common stock, (ii) options to purchase 15,928 shares of common stock, of which 3,982 are currently exercisable and (iii) warrants to purchase 770 shares of common stock, all of which are currently exercisable. Excludes: (i) 125,450 shares of common stock underlying vested restricted stock units which are issuable upon Mr. Bee’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances), (ii) 100,000 shares of common stock underlying unvested restricted stock units granted to Mr. Bee which are issuable upon Mr. Bee’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances) and (iii) options to purchase 11,946 shares of common stock. Mr. Bee has no voting rights with respect to the restricted stock units until the underlying shares are issued. |

| (5) | Includes: (i) 7,927 shares of common stock underlying vested restricted stock units which are issuable upon Ms. Gilfillan’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances) and (ii) options to purchase 5,310 shares of common stock, all of which are currently exercisable. Ms. Gilfillan has no voting rights with respect to the restricted stock units until the underlying shares are issued. |

| (6) | Includes: (i) 100,750 unrestricted shares of common stock, (ii) 7,927 shares of common stock underlying vested restricted stock units which are issuable upon Mr. Schafer’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances), (iii) options to purchase 5,310 shares of common stock, all of which are currently exercisable and (iv) warrants to purchase 770 shares of common stock, all of which are currently exercisable. Mr. Schafer has no voting rights with respect to the restricted stock units until the underlying shares are issued. |

| (7) | Includes: (i) 6,154 unrestricted shares of common stock, (ii) 7,409 shares of common stock underlying vested restricted stock units which are issuable upon Mr. Waldkirch’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances), (iii) options to purchase 5,310 shares of common stock, all of which are currently exercisable and (iv) warrants to purchase 577 shares of common stock, all of which are currently exercisable. Mr. Waldkirch has no voting rights with respect to the restricted stock units, the stock options or the warrants until the underlying shares are issued. |

| (8) | Includes: (i) 16,854 unrestricted shares of common stock, (ii) 7,927 shares of common stock underlying vested restricted stock units which are issuable upon Mr. Zinke’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances), (iii) options to purchase 5,310 shares of common stock, all of which are currently exercisable and (iv) warrants to purchase 770 shares of common stock, all of which are currently exercisable. Mr. Zinke has no voting rights with respect to the restricted stock units until the underlying shares are issued. |

| (9) | Includes: (i) 1,540 unrestricted shares of common stock, (ii) options to purchase 6,372 shares of common stock, of which 1,593 are currently exercisable and (iii) warrants to purchase 770 shares of common stock, all of which are currently exercisable. Excludes: (i) 42,186 shares of common stock underlying vested restricted stock units which are issuable upon Mr. Alexander’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances), (ii) 25,000 shares of common stock underlying unvested restricted stock units granted to Mr. Alexander which are issuable upon Mr. Alexander’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances) and (iii) options to purchase 4,779 shares of common stock. Mr. Alexander has no voting rights with respect to the restricted stock units until the underlying shares are issued. |

| (10) | Includes: (i) 308 unrestricted shares of common stock, (ii) options to purchase 3,900 shares of common stock, of which 975 are currently exercisable and (iii) warrants to purchase 154 shares of common stock, all of which are currently exercisable. Excludes: (i) 12,133 shares of common stock underlying vested restricted stock units which are issuable upon Mr. Francis’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances), (ii) 7,661 shares of common stock underlying unvested restricted stock units granted to Mr. Francis which are issuable upon Mr. Francis’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances) and (iii) options to purchase 2,925 shares of common stock. Mr. Francis has no voting rights with respect to the restricted stock units until the underlying shares are issued. |

| (11) | Includes: (i) 429,819 unrestricted shares of common stock reported in the Schedule 13 G/A filed with the SEC on January 4, 2022 (the “Phoenix SC 13 G/A”), (ii) 77,000 unrestricted shares of common stock and (iii) warrants to purchase 121,833 shares of common stock, all of which are currently exercisable. The business address of the beneficial owner as disclosed in the Phoenix SC 13 G/A is Suite 10.3, West Wing, Rohas PureCircle, No. 9 Jalan P. Ramlee, 50250 Kuala Lumpur, Malaysia. |

PROPOSAL NO. 1

1: ELECTION OF DIRECTORS PROPOSAL

Our Board currently consists of fivesix members. The Nominating and Corporate Governance Committee and Board have unanimously approved the recommended slate of foursix directors. Mr. Moylan is not standing for reelection at this meeting.

The following table shows the Company’s nominees for election to the Board. Each nominee, if elected, will serve until the next Annual Meeting of ShareholdersStockholders and until a successor is named and qualified, or until his earlier resignation or removal. All nominees are members of the present Board of Directors. We have no reason to believe that any of the nominees is unable or will decline to serve as a director if elected. Unless otherwise indicated by the shareholder,stockholder, the accompanying proxy will be voted for the election of the foursix persons named under the heading “Nominees for Directors.” Although the Company knows of no reason why any nominee could not serve as a director, if any nominee shall be unable to serve, the accompanying proxy will be voted for a substitute nominee.

NOMINEES FOR DIRECTOR

| Name of Nominee | | Age | | Principal Occupation | | Director Since |

| Edward M. Karr | | 47 | | Chief Executive Officer, President and Director of USG and Director of Dataram Memory | | 2015 |

| Timothy M. Janke | | 65 | | Director of USG | | 2017 |

| James Dale Davidson | | 70 | | Director of USG | | 2017 |

| John N. Braca | | 59 | | Director of USG | | 2017 |

| Name | | Age | | Position | | Director Since |

| Luke Norman | | 51 | | Chairman | | 2022 |

| George Bee | | 64 | | President, Chief Executive Officer and Director | | 2020 |

| Tara Gilfillan | | 52 | | Director | | 2020 |

| Robert W. Schafer | | 69 | | Director | | 2020 |

| Michael Waldkirch | | 53 | | Director | | 2021 |

| Ryan K. Zinke | | 60 | | Director, Consultant | | 2019 |

The Nominating and Corporate Governance Committee and the Board seek, and the Board is comprised of, individuals whose characteristics, skills, expertise, and experience complement those of other Board members. We have set out below biographical and professional information about each of the nominees, along with a brief discussion of the experience, qualifications, and skills that the Board considered important in concluding that the individual should serve as a current director and as a nominee for election or re-election as a member of our Board.

Nominees Biographies

Edward M. KarrLuke Norman has served since December 2017 as the chief executive officer, president and director of Northern Lion Gold Corp., a Canada-based mineral exploration company listed on the TSX Venture Exchange. Since March 2021, he has also served as the chief executive officer and director of Leviathan Gold Ltd., another mineral exploration company listed on the TSX Venture Exchange. Since 2000, Mr. Norman has served as an independent consultant to companies in the metals and mining industry. He has also served since 2016 as the chairman of Silver One Resources and since 2020 as a director of Black Mountain Gold USA Corp., both of which are mineral exploration companies listed on the TSX Venture Exchange. Mr. Norman was among the founding shareholders of Gold King Corp., a private company that combined with our predecessor, Dataram Corporation, in 2016 to form U.S. Gold Corp. Mr. Norman is qualified to serve as Chairman of our Board of Directors because of his expertise in mineral exploration, finance, corporate governance, mergers and acquisitions and corporate leadership.

George Bee has been serving as our director since November 2020, as our President since August 2020 and as our Chief Executive Officer since November 2020. Mr. Bee was appointed Chairman of our Board in March 2021 and served in this role until May 2022. He is a Directorsenior mining industry executive, with deep mine development and operational experience. He has an extensive career advancing world-class gold mining projects in eight countries on three continents for both major and junior mining companies. Currently, he serves as the Company’s President, a position he has held since August 2020, when, pursuant to the terms and conditions of the Merger Agreement, Mr. Karr relinquished his position as President and our Board appointed Mr. Bee as President of the Company, since Juneeffective on the closing of the Merger. In 2018, Mr. Bee concluded a third term with Barrick Gold Corporation (“Barrick Gold”) (NYSE: GOLD) as Senior VP Frontera District in Chile and Argentina working to advance Pascua Lama feasibility as an underground mine. This capped a 16-year tenure at Barrick Gold, where he served in multiple senior level positions, including Mine Manager at Goldstrike during early development and operations, Operations Manager at Pierina Mine taking Pierina from construction to operations, and General Manager of Veladero developing the project from advanced exploration through permitting, feasibility and into production. Previously, Mr. Bee held positions as CEO and Director of Jaguar Mining Inc. between March 2014 and December 2015, and has been the President and Chief Executive Officer, and a DirectorCEO of USG since April 2016. Mr. Karr became the PresidentAndina Minerals Inc. from February 2009 until January 2013 and Chief ExecutiveOperating Officer for Aurelian Resources, Inc. from 2007 to 2009. As Chief Operating Officer of the Company on May 23, 2017 and remains a memberAurelian Resources in 2007, he was in charge of the board.project development for Fruta del Norte in Ecuador until Aurelian was acquired by Kinross Gold in 2008. Mr. Karr is an international entrepreneur and founder of several investment management companies based in Geneva, Switzerland. In addition, Mr. Karr is a Director of Pershing Gold Corp., an emerging Nevada gold producer, member of the Audit Committee of the Company and a Director and Chair of the Audit Committee of Levon Resources. Mr. Karr previouslyBee has served on the boards of PolarityTE, Inc. (formerly Majesco Entertainment Company) and Spherix Incorporated. Mr. Karr is a board member and past President of the American International Club of Geneva and Chairman of Republican’s Overseas Switzerland. Mr. Karr has more than 25 years of capital markets experience as an executive manager, financial analyst, money manager and investor. In 2004, Futures Magazine named Mr. Karr as one of the world’s Top Traders. He is a frequent contributor to the financial press. Mr. Karr previously worked for Prudential Securities in the United States. Before his entry into the financial services arena, Mr. Karr was affiliated with the United States Antarctic Program and spent thirteen consecutive months working in the Antarctic, receiving the Antarctic Service Medal for winter over contributions of courage, sacrifice and devotion. Mr. Karr studied at Embry-Riddle Aeronautical University, Lansdowne College in London, England and received a B.S. in Economics/Finance with Honours (magna cum laude) from Southern New Hampshire University. Mr. Karr is qualified to serve on our Board because of his global operating and executive management experience; deep knowledge of capital markets; experience in public company accounting, finance, and audit matters as well as his experience in a range of board and committee functions as a member of various boards.

Timothy M. Janke has been serving as a member of the board of directors of USG since April 2016. In addition, he has been serving as the Chief Operating Officer of Pershing Gold Corp. since August 2014. Since November 2010, Mr. Janke has been the president of his own consulting business providing mine operatingStillwater Mining Company, Sandspring Resources Ltd., Jaguar Mining, Peregrine Metals Ltd. and evaluation services to several mining companies. Beginning in July 2012, he provided consulting services at the Relief Canyon Project advising the Company on mine start-up plans and related activities. From June 2010 to August 2014, Mr. Janke served as Vice President and Chief Operating Officer of Renaissance Gold, Inc. and its predecessor Auex Ventures, Inc.Minera IRL. He was General Manager-Projects for Goldcorp Inc. and its predecessor Glamis Gold, Inc. from July 2009 to May 2010, Vice President and General Manager of the Marigold Mine from February 2006 to June 2009, and its Manager of Technical Services from September 2004 to January 2006. Since August 2011, Mr. Janke has served as a director for Renaissance Gold. He is a past Director of both the Nevada Mining Association, and Silverado Area Council Boy Scouts. He has a B.S. in Mining Engineering from the Mackay School of Mines. Mr. Janke is qualified to serve on our Board because of his more than 40 years of engineering and operational experience in the mining industry, and broad range of expertise in mining operations throughout the USA, Canada and Australia.

James Dale Davidson has been a member of S.A.C.S. OF Beaverton LLC since 2015, Founding Director of Vamos Holdings since 2012, Director of Solar Avenir since 2016, Founding Director of Telometrix since 2016, and Founding Managing Member of Goldrock Resources, LLC since 2016. Mr. Davidson first became active in the mining business after his forecast of the collapse of the Soviet Union was born out. After several small successes, Davidson teamed with Richard Moores in 1996 to launch Anatolia Minerals with an initial capital of $800,000. At its peak, the company attained a market cap of $3.5 billion. Davidson, a graduate of Oxford University, has had a successful career as a serial entrepreneur. He is the author ofBlood in the Streets: Investment Profits in a World Gone Mad, The Great Reckoning: Protect Yourself in the Coming Depression andThe Sovereign Individual (all with Lord William Rees-Mogg) andBrazil is the New America, The Age of Deception, andThe Breaking Point. Mr. Davidson qualified to serve on our Board because of his experience in mining operations and corporate governance.